Apply for the Chase Freedom Flex Credit Card with Invitation Code:

The Chase Freedom Flex Card could be an excellent choice for those who want to earn cashback or unlimited rewards points in a wide variety of categories. The one-time bonus adds more value to this credit card with no annual fee.

There are some ancillary benefits of this credit card, such as trip cancellation, cell phone protection, and interruption insurance. However, if you want to want to be bothered with rotating bonus categories or don’t want to spend money in the higher-earning categories, then you should look for a better fit.

Benefits of Chase Freedom Flex Credit Card:

There are several cashback rewards & benefits that come with the Chase Freedom Flex credit card. Here are some of the benefits that you will get with this credit card:

- You will get a $200 bonus plus a 5% gas station cashback offer with this card. To earn a $200 bonus after spending $500 on purchases in the first 3 months from your account opening.

- Earn 5% on up to $1,500 on combined purchases in bonus categories every quarter you activate.

- You will receive 5% on your travel purchases through Chase Unlimited Rewards.

- Get 3% on dining at restaurants, including takeout and eligible delivery services.

- Earn 3% on drugstore purchases and 1% on all the other purchases.

- This credit card comes with a 0% intro APR for the first 15 months from your account opening on purchases and balance transfers. After that period, the variable APR of 14.99% to 23.74%.

- You will not be charging an annual fee for all the great features that come with your Freedom Flex Card.

- Your cash back rewards will not expire as long as your account is open. Also, there is no minimum to redeem for cashback.

Chase Freedom Flex Credit Card Interest Rates and Fees:

Interest Rates and Interest Charges:

- APR for Purchase: The purchase APR is 0% for the first 15 months from the date of your account opening. After that, 14.99% to 23.74% based on your creditworthiness, this may vary with the market based on the Prime Rate.

- APR for Balance Transfer: For the first 15 months from the date of your account opening, your APR will be 0%. After that, your APR for the balance transfers will vary between 14.99% to 23.74%.

- APR for Cash Advance: The cash advance ARP of this credit card is 24.99%, which may vary with the market based on Prime Rate.

- Minimum Interest: None.

Fees:

- Annual Fee: Chase Freedom Flex credit card has no annual fee.

- Balance Transfers Fee: For the first 60 days from your account opening, either you will be charged $5 or a minimum of 3% of the transferred amount. After that, you will be charged $5 or a minimum of 5% of the amount of each transfer, whichever is greater.

- Cash Advances Fee: Either you will be charged $10 or a minimum of 5% of each transaction, whichever is greater.

- Foreign Transactions Fee: For the foreign transaction fee, you will be charged 3% of the amount of each transaction in US dollars.

- Late Payment Fee: If you fail to make the payment by the due date, you will be charged up to $40.

Apply for Chase Freedom Flex Credit Card with Invitation Code:

If you are interested in applying for the Chase Freedom Flex Credit Card, then you can follow these simple instructions below:

- Firstly, you have to click on this link www.getchasefreedomflex.com.

- By clicking on the above-mentioned link, you will be redirected to the credit card application page.

- You have to provide your invitation number and zip code on the given fields.

- After entering all the necessary details in the given spaces, select the Next button.

- Then, you can simply follow the on-screen guideline to apply for Freedom Flex Credit Card.

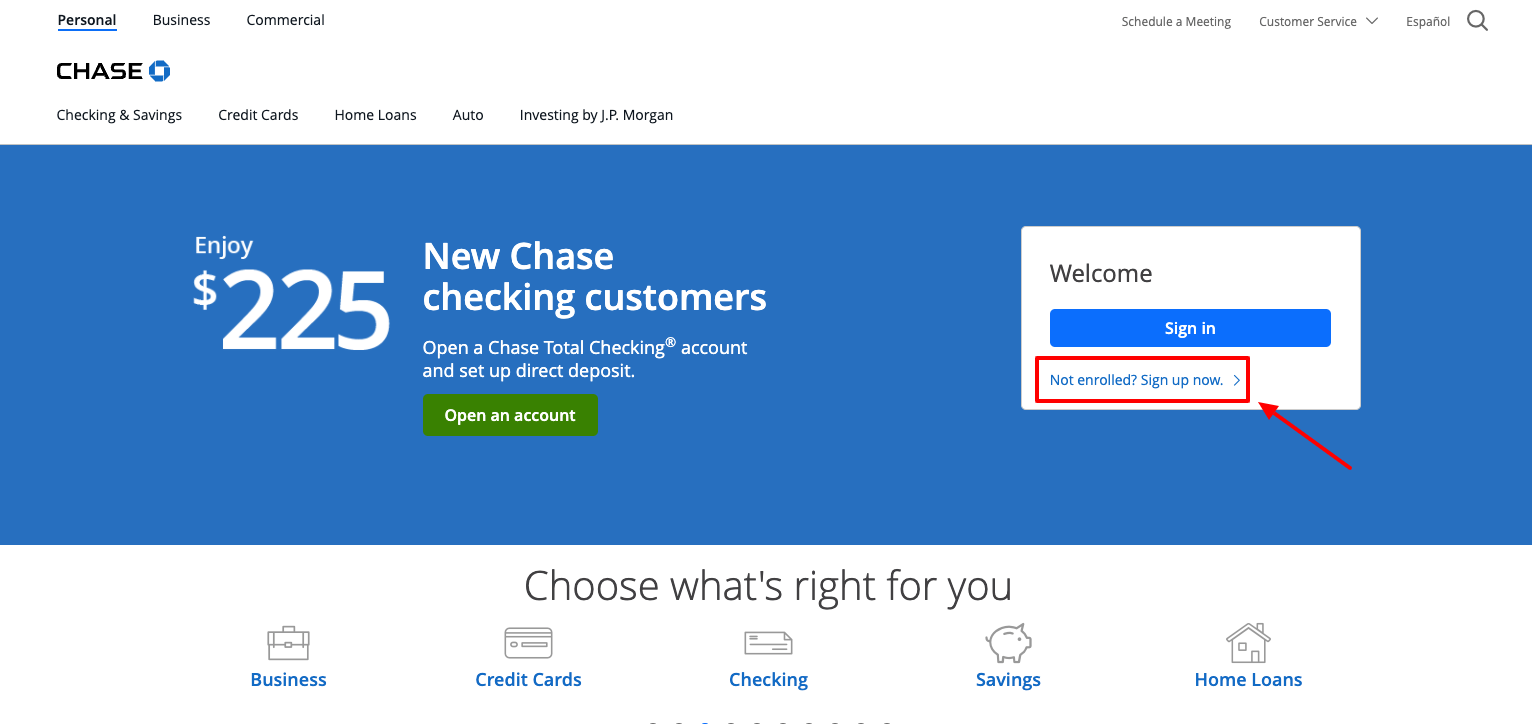

How to Create a Chase Online Account Access:

In order to manage your Chase credit card, you have to set up online access. You have to follow these simple instructions below to set up the Chase Online account access:

- You have to visit the Chase website at www.chase.com.

- Then, from the right-hand side of the page, you will get the login section, where click on Not enrolled? Sign up now.

- You need to choose your account type and enter your account number, card number, or application number.

- Then, on the next page, you have to enter your social security number.

- You have to create a new username for your online Chase account.

- After entering all the necessary details in the given spaces, select the Next button.

- Then, you can follow the on-screen guideline to set up the Chase online account access.

Make the Payment for Chase Freedom Flex Credit Card Bill:

You will get multiple options to pay your Chase Freedom Flex Credit Card bill. You can choose any of the following methods to pay your credit card bill:

Online Payment Method:

It is the fastest and easiest way to pay your Chase Freedom Flex credit card bill. If you like to make the online payment, then follow these simple instructions below:

- Firstly, you have to click on this link chase.com.

- Then, from the right-hand corner of the page, you have to select the Sign In option.

- You have to provide your registered username and password in the given space.

- After entering your login credentials in the given spaces, select the Sign In option.

- Once you logged in to your Chase account, you have to look for the credit card payment option.

Pay by Mail:

If you like to pay for your Chase Freedom Flex Credit Card, then you can use the mail service. Along with all the other required credentials, you need to send your payment stub to this address below:

Cardmember Services

P.O. Box 6294

Carol Stream, IL 60197-6294

Those who want to pay their credit card bill through the overnight payment method, then send your payment stub to this address below:

Chase Card Services

201 N. Walnut Street

De1-0153

Wilmington, DE 19801

Pay by Phone:

To make the payment for your Chase credit card bill by phone, call 1-800-436-7958. After calling on this number, you just need to follow the on-call instructions to make the payment for your Chase Freedom Flex Credit Card bill.

Chase Contact Info:

Still, if you face any problems while applying for the Chase Freedom Flex Credit Card, then you can contact the customer service department.

Call At: 1-800-935-9935

Service Hours:

Mon-Fri: 7 AM to 11 PM

Sat-Sun: 10 AM to 7 PM

Reference Link: